COMING SOON!

We’re preparing to launch a lending-first financial infrastructure platform that unifies

digital credit, payments, banking and escrow for modern institutions.

Introducing a Lending-First Infrastructure Layer

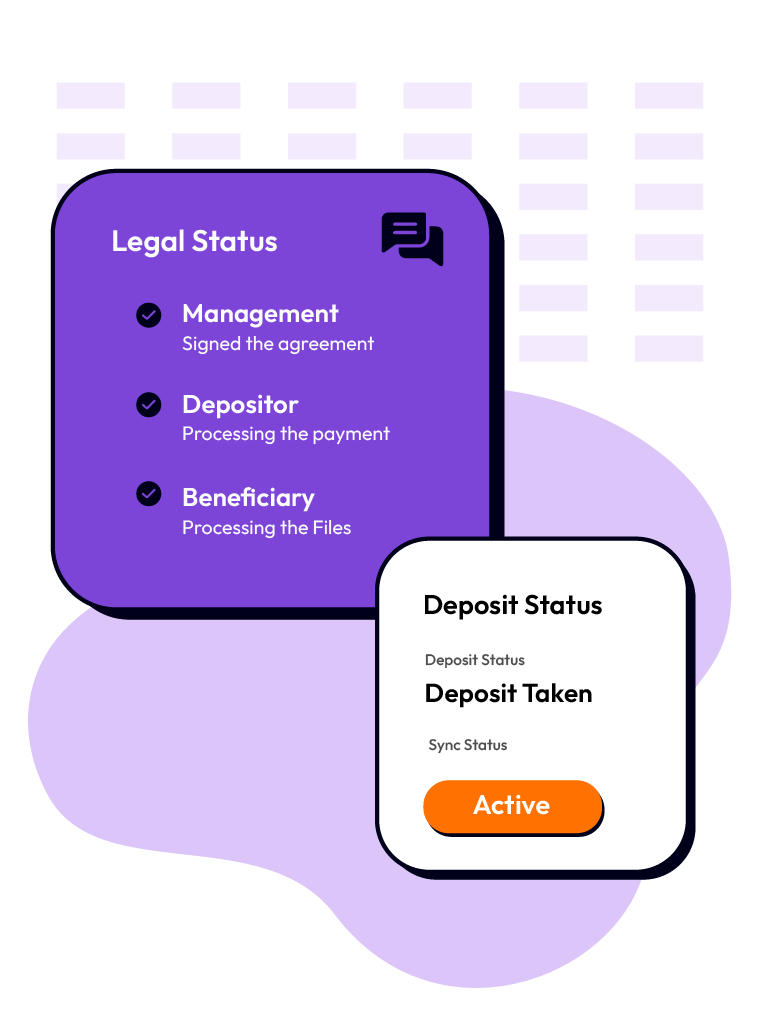

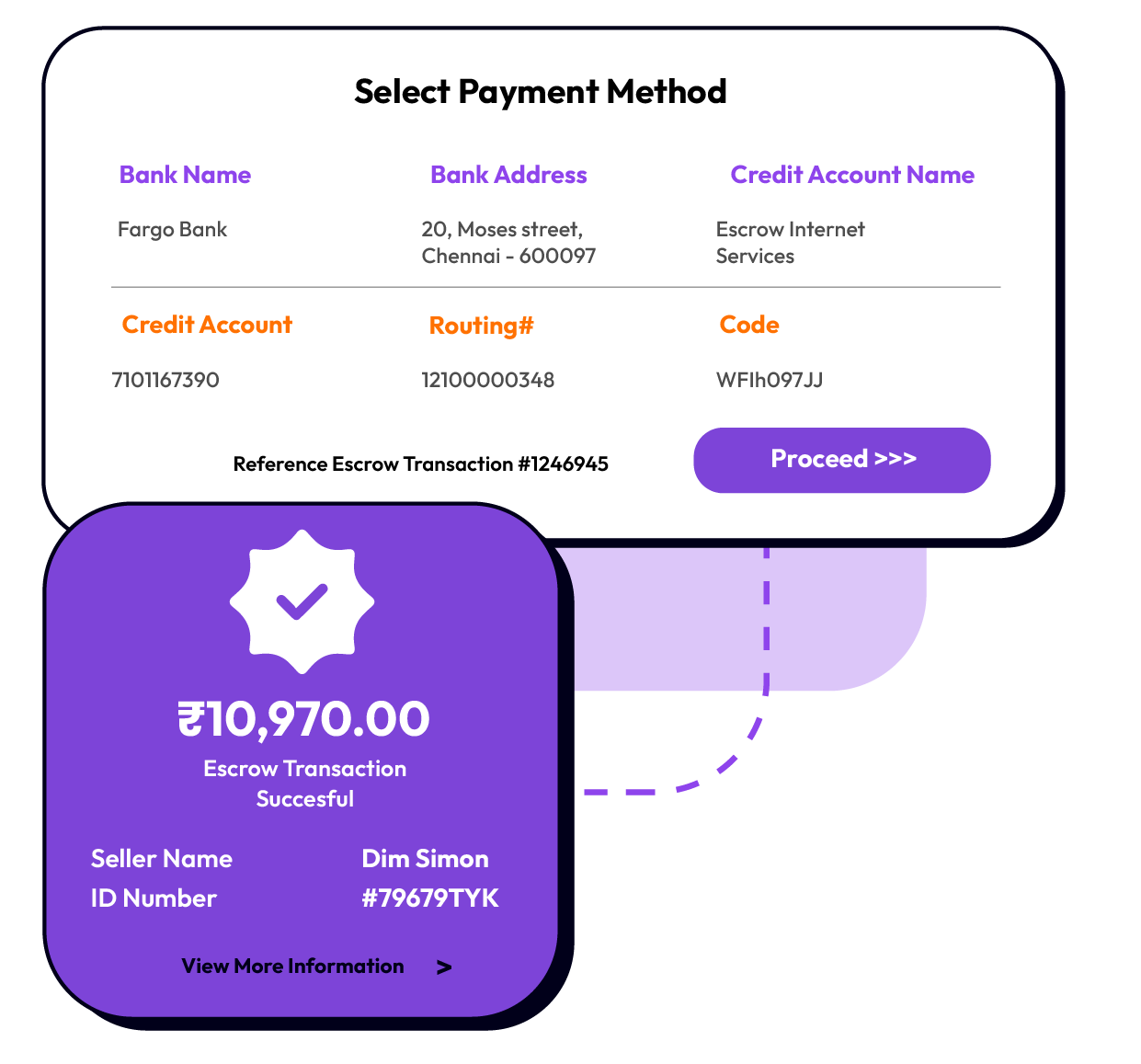

Protect your deals with our reliable escrow services

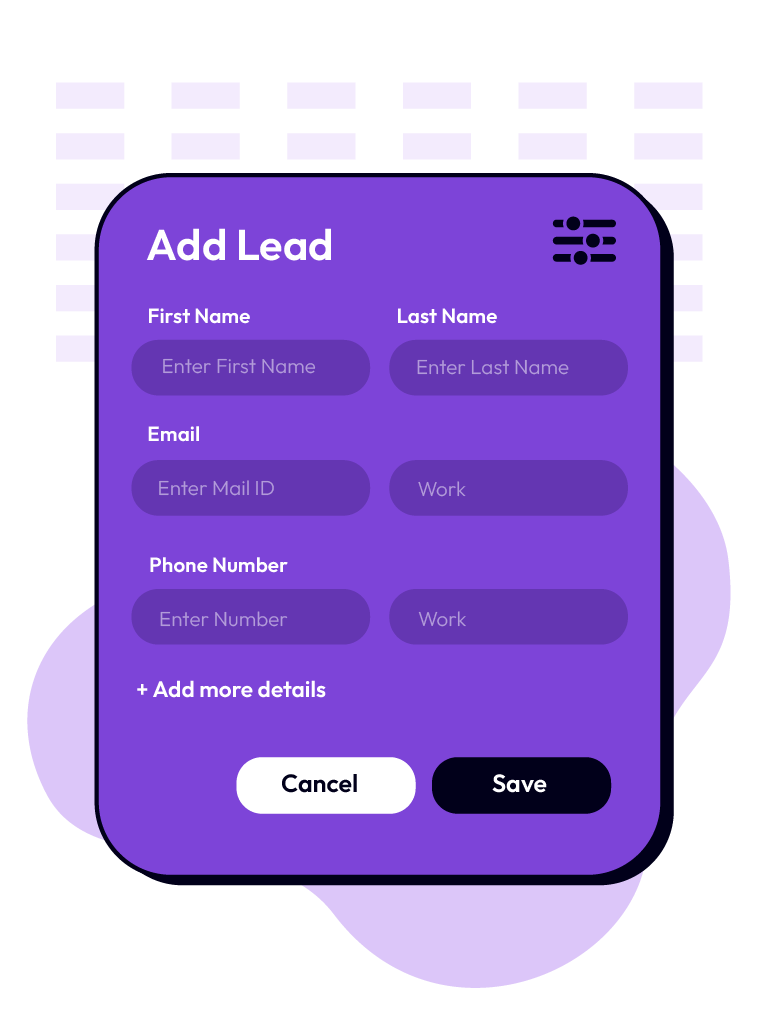

LOS (Loan Origination System)

Our Loan Origination System helps businesses manage end to end lending workflows with clarity and control. It supports efficient application reviews, quick decision making and smooth customer handling.

LMS (Loan Management System)

Our Loan Management System simplifies repayment tracking, schedule updates, customer communication and account monitoring. It helps financial teams manage ongoing loans with reliability and better operational oversight.

Verification /

Onboarding

Our verification and onboarding service helps businesses validate customers securely, collect required information, confirm identities and activate accounts quickly so users can start using your platform with confidence.

Lending-focused narrative

We now prioritise lending solutions that help businesses manage credit workflows with clarity and confidence. Our digital tools support precise financial decisions and strengthen essential lending operations for better outcomes.

Loan Origination System

We support businesses in handling lending processes with accuracy, enabling quicker evaluations, stronger compliance, and steady borrower movement through every lending stage.

Loan Management System

We assist businesses in monitoring loans, ensuring correct repayments, better risk oversight, and reliable lifecycle tracking for expanding lending portfolios with operational clarity.

Simple solutions for scaling success

Seamless payments to achieve unlimited potential

Validate your idea

Whether you're a startup exploring new markets or an established enterprise launching innovative projects, our trusted escrow solutions ensure your ideas are protected.

Company incorporation

Our secure escrow platform offers a reliable way to safeguard funds during the incorporation process, ensuring that both parties meet their obligations with confidence.

Sell to businesses

By utilizing our trusted escrow solutions, you can engage in business deals with confidence, knowing that your funds are protected until all terms are met. Build lasting relationships.

A gateway for convenience

Tailored solutions for your financial journey

Payment Gateway

We're expanding the strength and flexibility of our payment-focused platform to support more reliable and efficient transaction experiences.

Centralized Payment Platform

A smarter system that handles every step of a payment, from starting a transaction to routing it, getting approvals, completing settlement and helping manage any disputes, all in one place.

Configurable Payment Flows

Custom payment journeys that allow merchants to set rules, automate steps and use partner integrations, making it easier to match the payment experience to their business needs.

Enhanced Verification & Risk Screening

Stronger protection for transactions through smarter checks, authentication options, fraud detection models and safety rules that help keep payments secure.

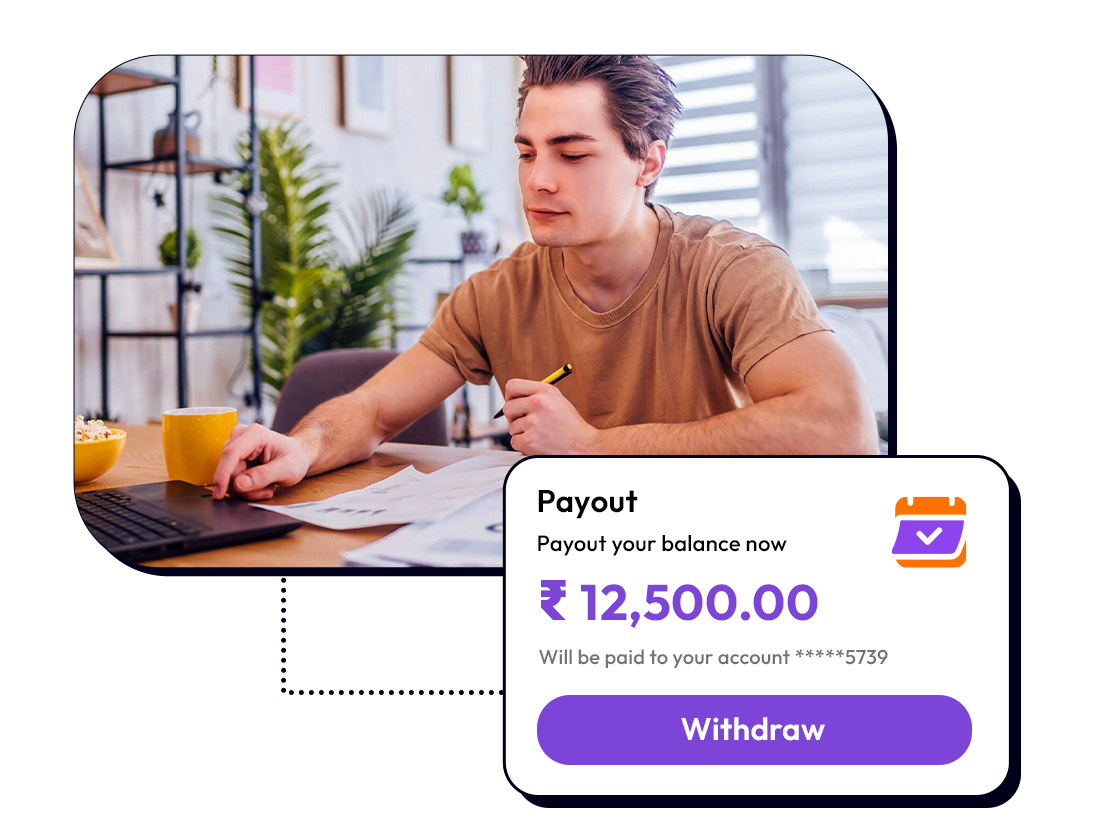

Payout

We're expanding the control, speed and reliability of our payout platform to help businesses manage funds efficiently and securely.

Customizable Payment Paths

Flexible workflows that let businesses define how and when funds are sent, automate rules, and connect with partner systems to match their operations.

Secure Verification & Fraud Guard

Advanced verification and monitoring tools that confirm recipient accounts, detect irregular activity, and reduce risks of errors or fraud.

Connected Financial Rails

Integration with banking networks, accounting platforms, and reporting dashboards to provide real-time insights, faster reconciliations, and full transparency of all payouts.

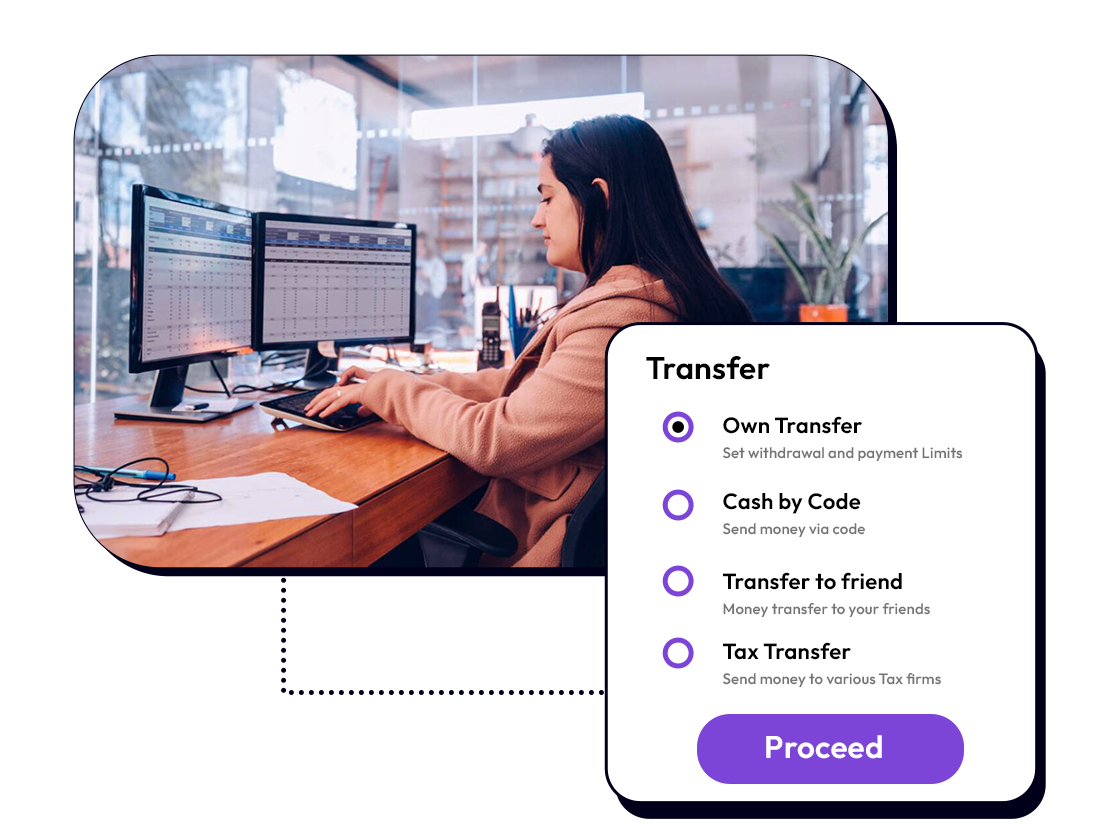

Banking

We’re strengthening banking capabilities to give businesses more control, transparency, and flexibility in managing accounts and financial operations.

Smart Account Management

A centralized system to create, manage, and monitor business accounts, providing full visibility into balances, transactions, and account activity in real time.

Flexible Fund Movement

Tools to move funds efficiently between accounts, schedule transfers, and automate recurring payments, giving businesses complete control over their cash flow.

Advanced Compliance & Security

Built-in compliance checks, verification procedures, and fraud monitoring to ensure all banking operations are secure and meet regulatory standards.

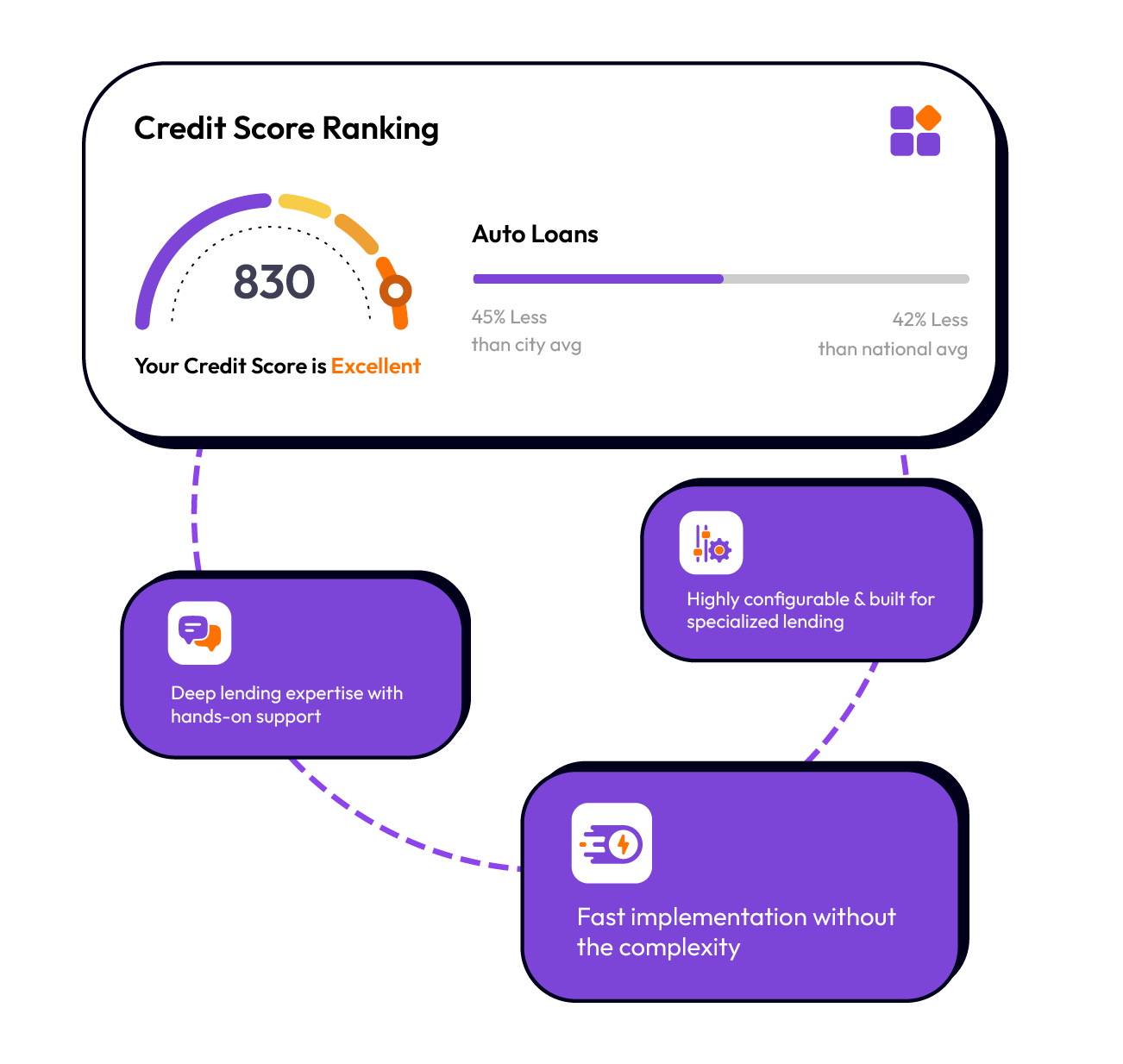

Lending Suite (Core)

As Cerebrofin launches and evolves, we're expanding the depth and configurability of our lending-first stack.

Advanced Lending Management (LMS)

Deeper lifecycle management for retail, SME and enterprise loans, from creation and approval to disbursal, repayment and closure.

Configurable LOS Journeys

Highly customisable origination flows with rule engines, decisioning and partner-led journeys.

Richer Verification & Onboarding

Expanded KYC options, document intelligence, underwriting integrations and risk controls.

Deeper Integration with Cerebrofin Rails

Even tighter coupling between lending, payments, escrow and banking for disbursals, collections, reconciliations and portfolio insights.

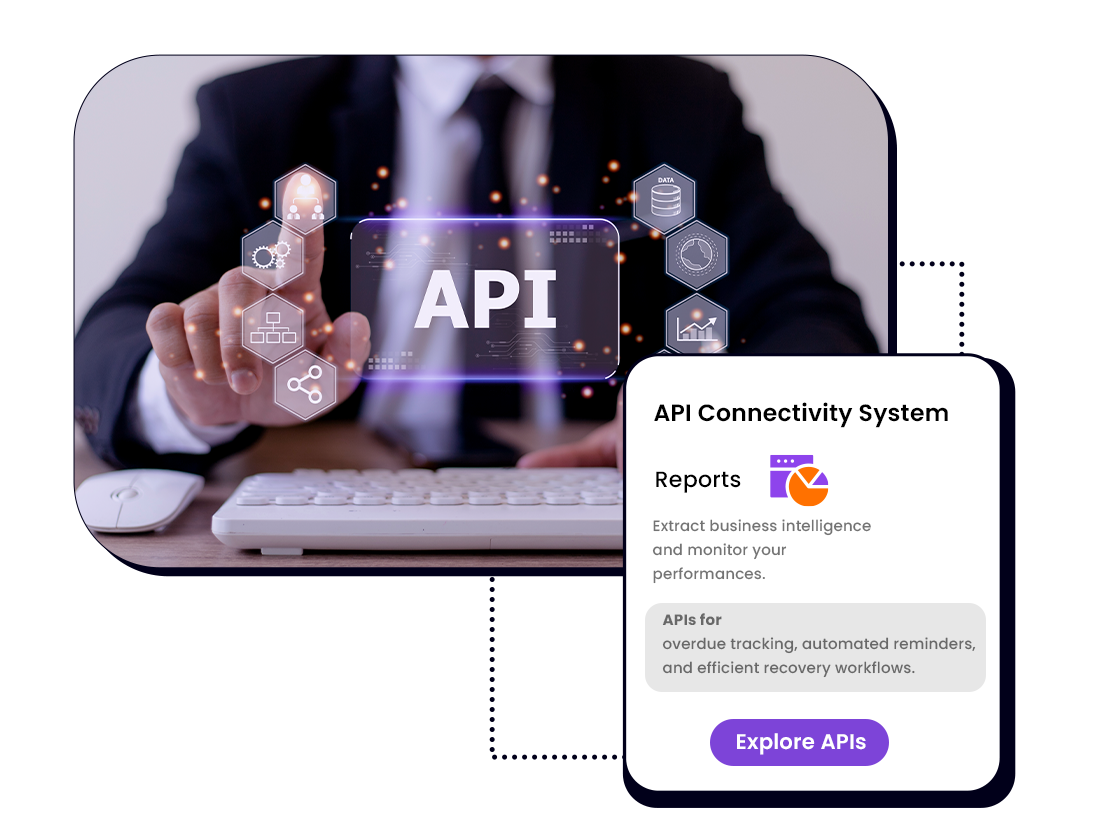

API Connectivity

We are enhancing API-first connectivity to make it easier for developers and businesses to integrate payments, payouts, and banking into their own systems.

Robust API Framework

A reliable API framework that allows developers to connect their platforms to Cerebrofin quickly and efficiently. It handles authentication, data exchange, and transaction requests in a consistent way.

Custom Integration Options

Flexible APIs that let businesses tailor connections to their workflows. Developers can automate tasks, define data flows, and connect only the services they need.

Real-Time Data & Insights

APIs provide instant access to transaction data, account balances, and operational metrics, helping businesses monitor performance and make informed decisions in real time.

Comprehensive solutions that are change-bringers

Our cutting-edge solution brings together all your payment needs in one place, offering a seamless and efficient experience. Embrace the future of payment management.

Technology-centric

We give major emphasis on the use of advanced technological solutions to enhance the payment process. We focus on seamless integrations for a secure payment experience.

Efficiency and simplicity

We bring together all the essential payment processing tools and features you need, eliminating the hassle of managing multiple systems. We are a one-stop solution provider.

Secure payment for peace of mind

Work with us

We’re currently onboarding leadership team members and partners as we prepare to launch Cerebrofin.

Get Started